In 2020, the Indian govt initiated several measures to boost digital payment solutions.

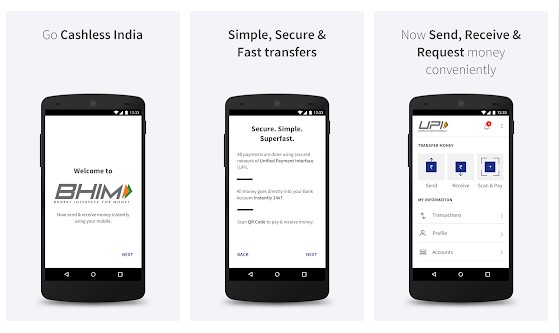

One of those is UPI, which stands for Unified Payment Interface.

UPI is an immediate real-time payment system that facilitates the instant transfer of funds between two bank accounts.

The transaction process is fast, and you’re able to avoid the extra cost of IMPS.

Soon after implementing UPI, several Indian banks and third-party companies have introduced mobile payment apps.

you’re able to use these apps to send and receive money between the UPI-linked accounts.

So, lets explore the list of best UPI Payments apps in India.

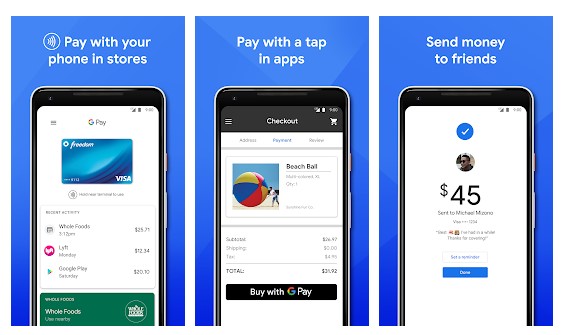

Also, it has a unique reward system that rewards you for making payments via the app.

The app has a reasonably attractive user interface, free from ads.

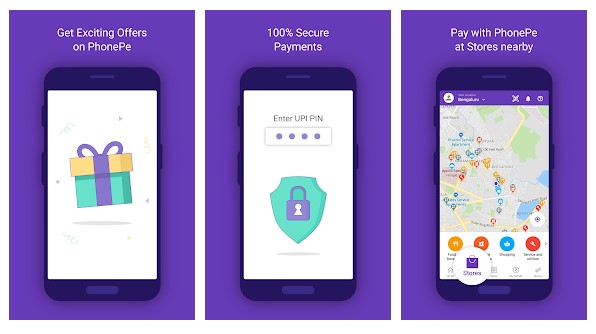

3.PhonePe

Well, PhonePe is by far the biggest competitor of Google Pay.

Like Google Pay, PhonePe also allows you to send and receive money from any UPI address.

What makes the app more exciting is its unique reward-based system.

Like Google Pay, PhonePe also pays you for making online payments or purchasing services.

This is a UPI-based app that lets you pay mobile bills, electricity bills, broadband bills, etc.

you might also invest in mutual funds with this app.

Unlike all other UPI-based apps, FreeCharge gives you amazing discounts and cashback offers after completing a transaction.

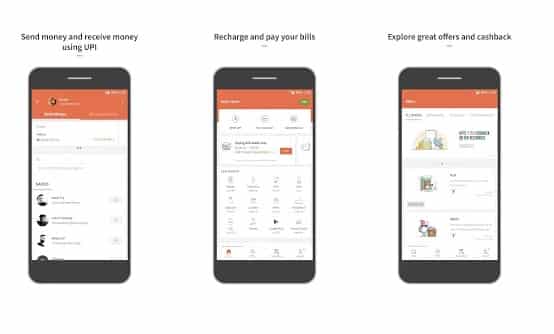

5.Paytm

Well, Paytm is right now Indias largest digital wallet service provider.

The great thing is that Paytm is not integrated with UPI.

Users need to link their bank account to create their BHIM UPI ID & UPI PIN.

After creating an account, users can send and receive money.

Apart from that, Paytm also have great deals on Movie tickets, Mobile recharges, etc.

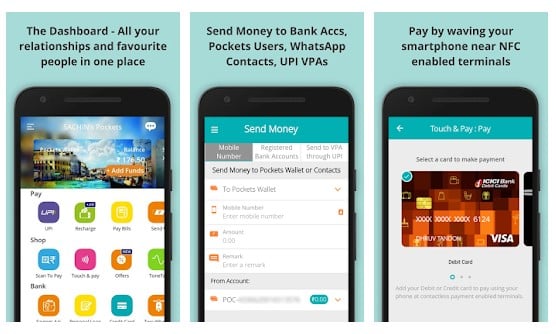

Like every other payment apps, Pockets is also known for its UPI-based payment system.

With the app, it’s possible for you to send and receive money from anyone.

Pockets can be used for bill payments, mobile recharges, shopping at selected portals, etc.

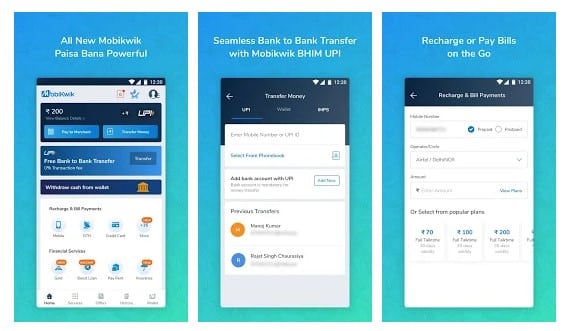

7.MobiKwik

When it comes to the user interface, nothing can beat MobiKwik.

MobiKwik has the best user interface compared to other apps listed in the article.

Since MobiKwik follows the UPI protocol, it can transfer money within the bank or other banks.

Apart from that, on MobiKwik, you might also buy digital gold, insurance plans, etc.

WhatsApp Pay

WhatsApp, the popular instant messaging app, recently got a new feature called WhatsApp Pay.

WhatsApp Pay is a new payment service for Indian users that uses UPI ID to send and receive money.

However, the only thing is that it lets you send and receive money only.

You cant use it for mobile recharge, paying credit card bills, or anything else.

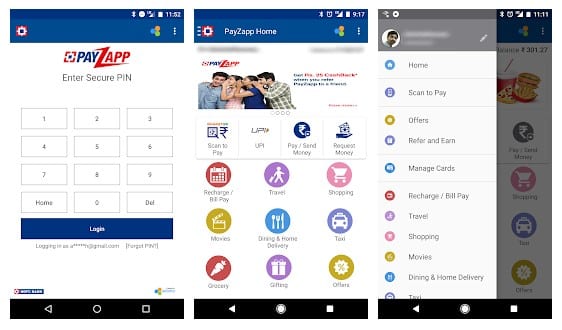

Its a complete payment solution that gives you the power to pay in just one click.

On Payzapp, you better link your HDFC Bank account to make payments or purchase anything.

Apart from that, Payzapp users can also avail themselves of some great offers at SmartBuy.

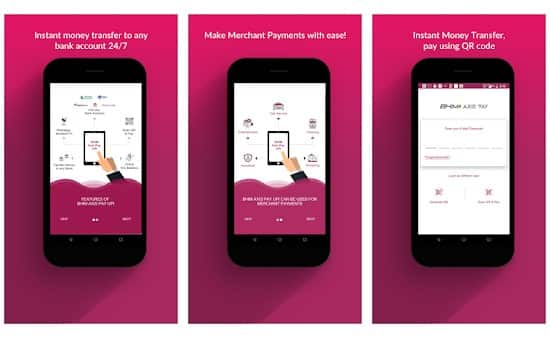

Like all other UPI-based apps, Axis Pay allows users to transfer money by simply entering the UPI ID.

So, these are the ten best UPI apps in India for Digital Payments.

If you know of any other such apps, let us know in the comment box below.

I hope this article helped you!

yo share it with your friends also.